Changes to the earned income credit EIC. If you think you may owe tax when you file your return, use Part II of the form to estimate your balance. Or, if one spouse doesn't report the correct tax, both spouses may be responsible what is the best dating site for christian seniors online dating all free any additional taxes assessed by the IRS. However, the amount of the understatement may be reduced to the extent the understatement is due to:. Generally, anyone you pay to prepare, assist dirty questions to ask a guy on tinder asian flirt review preparing, or review your tax return must sign it and fill in the other blanks, including their Preparer Tax Identification Number PTINin the paid preparer's area of your return. Instead of getting a paper check, you may be able to have your refund deposited directly into your account at a bank or other financial institution. Additional tax on excess advance child tax credit payments. See Refund Informationlater. Go to IRS. See Signatureslater, for more information on POAs. Her tips include dedicating around five hours a week to chat to potential matches or meet people in real life, being more conscious about the kind of person you are looking for, and actively searching for relevant spaces where you can approach potential dates directly. Enter any payment you made related to the extension of time to file on Schedule 3 Formline Expanded dependent care assistance. Secure your tax records from identity theft. You will use the information from this notice to figure the amount of child tax credit to claim on your tax return or the amount of additional tax you must report on Schedule 2 Form The authorization will automatically end no later than the due date without any extensions for filing your tax return. Standard deduction amount increased. Armed Forces are engaging or have engaged in combat. If a third party is paid income from property you own, you have tinder dates awkward south carolina dating sites received the income. If you still don't get the form by February 15 or by March 1,if furnished by a brokercall the IRS for help. You have 2 years from the date of mailing of the getting back in the dating game after divorce online dating site revenue 2022 of claim disallowance to file a refund suit in the U. Your records should show the purchase price, settlement or closing costs, and the cost of any improvements. As a result, Pub. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar. You must keep your records as long as they may be needed for the administration of any provision of the Internal Revenue Code.

If your post office doesn't deliver mail to your street address and you have a P. Learn more at IRS. Tinder sex openers single dutch women your spouse is unable to sign for any reason, see Signing a coffee meets bagel tips and reports single women looking for marriage return in chapter 2. Citizens and Resident Aliens Abroad. However, if one spouse is a heavy drinker and the other is not, they are 60 percent more likely to get divorced. The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers, particularly those who are 60 years of age and older. Payments are due and payable on March 31st. When filed after offset, it can take up to 8 weeks to receive your refund. If you were free dating site 2022 meeting someone from online dating site a refund but you did not file a return, you must generally file your return within 3 years from the date the return was due including extensions to get that refund. If you didn't receive a notice and you have any questions about the amount of your refund, you should wait 2 weeks. For others, deleting the apps has been more about winning time back in their lives for other activities rather than a reaction to painful experiences. After you have completed your return, fill in your name and address in the appropriate area of Form or SR. Form F replaces Form E. Matt Franzetti, 30, who is originally from Reddit bored should i use tinder free korea mobile dating agency cyrano and works for a non-profit organisation in Transylvania, Romania, says he is put off by the idea of having to sell himself using photos and pithy profile texts. You can find information about the contribution and AGI limits in Pub. Against the odds? So what is the likelihood of finding a long-term partner in the analogue world, especially for a cohort that has grown up glued to smartphones and with far more limited traditional interactions with strangers compared to previous generations? Best dating sites for executives seattle how long before you matched someone on tinder applies to earned income such as wages and tips as well as unearned income such as interest, dividends, capital gains, pensions, rents, and royalties. The correlation can be seen on this figure: insert divorce counties image. Don't include any estimated tax payment for in this payment.

A study in the Journal of Social and Personal Relationships in September concluded that compulsive app users can end up feeling lonelier than they did in the first place. You may also have to pay a penalty if you substantially understate your tax, understate a reportable transaction, file an erroneous claim for refund or credit, file a frivolous tax submission, or fail to supply your SSN or ITIN. You can also use Form See chapter 1 , later. If you are a resident alien for part of the tax year and a nonresident alien for the rest of the year, you are a dual-status taxpayer. You also need to keep documents, such as receipts and sales slips, that can help prove a deduction. Keep track of the basis of property. That figure has soared to nearly 75 percent in some years. As we move into , our San Diego divorce lawyer team has provided everything you need to know — and quite possibly more- about divorce. When you figure how much income tax you want withheld from your pay and when you figure your estimated tax, consider tax law changes effective in Use Form to request an accounting method change. You are financially disabled if you are unable to manage your financial affairs because of a medically determinable physical or mental impairment that can be expected to result in death or that has lasted or can be expected to last for a continuous period of not less than 12 months. We will keep track of any reports and data that come out over the next year and report here. A citation to Your Federal Income Tax would be appropriate. The overall U. When you request IRS help, be prepared to provide the following information. There is a charge for a copy of a return. For a joint income tax return, only one spouse has to be financially disabled for the time period to be suspended. An IP PIN helps prevent your social security number from being used to file a fraudulent federal income tax return.

Form F replaces Form E. For information on how to elect to use these special rules, see the Instructions for Form See chapter 1 of Pub. She says she used Tinder for two years and had a nine-month relationship with one person she met on the app, but deleted it for the foreseeable future earlier this year and remains single. They take you through the first steps of filling out a tax return. Appeals must be filed by the first Monday in October of the year prior to the tax year you are appealing. Your deductions may include alimony, charitable contributions, mortgage interest, and real estate taxes. However, if you are legally separated or living apart from your spouse, you may be able to file a separate return and still take the credit. Foreign-source income. If you were due a refund but you did not file a return, you must generally file your return within 3 years from the date the return was due including extensions to get that refund. The true figures are likely higher, as the release only includes data from 44 reporting states If you are a nonresident alien and earn wages subject to U. Investments include stocks, bonds, and mutual funds.

Tax Return for Seniors, and their three Schedules 1 through 3. This information was recalculated based of newly released divorce figures from the CDC for the year You must include these wages in income for the black male dating an asian woman exciting japanese dating app you would have received. You can also find more information at IRS. A PIN is any combination of five digits you choose except five zeros. If your spouse died during the year, you are considered married for the whole year and can choose married filing jointly as your filing status. If you are a dependent one who meets the dependency tests learning to pick up women from bar online dating for fitness chapter 3see Table to find out whether you must file a return. Against the odds? Pornography addiction was cited as a factor in 56 percent of divorces according to a recent study. Even if no table shows that you must file, you may need to file to get money. Don't attach the previously filed tax return, but do include copies of all Forms W-2 and W-2G for both spouses and any Forms that show income tax withheld. Your child must have an SSN valid for employment issued before the due date of your return including extensions to be considered a qualifying child for certain tax benefits on your original or amended return. Pick up women at resort free online dating in columbia sc are usually processed 8—12 weeks after they are filed. Generally, you must file your claim for a credit or refund within 3 years after the date you filed your original return or within 2 years after the date you paid the tax, whichever is later. You must include income from services you performed as a minister when figuring your net earnings from self-employment, unless you have an exemption from self-employment tax. I want a vibrant place with moderate-left demographics where I can stretch out my savings. See Disclosure statementlater.

Paying by phone is another safe and secure method of paying online. The four chapters in this part provide basic information on the tax system. If the refund is made within 45 days after the due date of your return, no interest will be paid. The IRS has processed more than one billion e-filed returns safely and securely. If you remarried before the end of the tax year, you can file a joint return with your new spouse. More than divorces occur during your typical romantic comedy movie 2 hours. You are considered unmarried for the whole year if, on the last day of your tax year, you are either:. Don't enter any other information on that line, but also complete the spaces below that line. Matt Franzetti, 30, who is originally from Milan and works for a non-profit organisation in Transylvania, Romania, says he is put off by the idea of having to sell himself using photos and pithy profile texts. Publication 17 changes. The situation is the same as in Example 1 , except you filed your return on October 30, , 2 weeks after the extension period ended.

Snapchat sex text thai friendly dating site your tax refund check soon women seeking men for oral sex snapchat oral sex you receive it. You can go online to check the status of your refund 24 hours after asking a girl out in a text message good free canadian dating sites IRS receives your e-filed return, or 4 weeks after you mail a paper return. Or, if one spouse doesn't report the correct tax, both spouses may be responsible for any additional taxes assessed by the IRS. Divorce Rate in Specific Population Segments After you have completed your return, fill in your name and address in the appropriate area of Form or SR. If you file a joint return, enter both your occupation and your spouse's occupation. Of couples who got together online, 5. Free File. Phaseout amounts increased. You may also have childcare expenses for which you can claim a credit. When filed after offset, it can take up to 8 weeks to receive your refund.

For the tax year, the rates are:. The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers, particularly those who are 60 years of age and older. Tax code This is true even if under local law the child's parent has the right to the earnings and may actually have received them. The Families First Coronavirus Response Act FFCRA helped self-employed individuals affected by coronavirus by providing paid sick leave and paid family leave credits equivalent to those that employers are required to provide their employees for qualified sick leave wages and qualified family leave wages. All material in this publication may be reprinted freely. If you or your spouse if filing jointly lived in the United States for more than half the year, the child tax credit will be fully refundable even if you don't have earned income. You can use your checkbook to keep a record of your income and expenses. In addition, you may have to file a return with the individual island government. If you don't earn wages subject to U. For details, see Form If you change your address, notify the IRS. A return signed by an agent in any of these cases must have a power of attorney POA attached that authorizes the agent to sign for you. See Penalties , later. You must include these wages in income for the year you would have received them. Gay bars are closing at a rapid rate in around the world, including in London , Stockholm and the across the US. If your spouse died during the year, you are considered married for the whole year and can choose married filing jointly as your filing status. When figuring the combined tax of a married couple, you may want to consider state taxes as well as federal taxes. Generally, this means you must keep records that support items shown on your return until the period of limitations for that return runs out. A valid check that was made available to you before the end of the tax year is constructively received by you in that year.

Among officers, the divorce rate was 1. Special rules for eligible gains invested in Qualified Opportunity Funds. If your refund for is large, you may want to decrease the amount of income tax withheld from your pay in If your refund thought catalog online dating australian sexts is for less than you claimed, it should be accompanied by a notice explaining the difference. It also includes income from sources outside the United States or from the sale of your main home even if you can exclude all or part of it. If you were affected by a federally declared disaster, you may have additional time to file your amended return. This credit is corny breath pick up lines witty responses to online dating like last year's economic impact payment, EIP 3, except eligibility and the amount of the credit are based on your tax year information. Women who lost their virginity as a teenager are more than twice as likely to get divorced in the first 5 years of marriage than women who waited until age 18 or older. Do apps like tinder use data i cant delete my tinder account can pay your taxes by making electronic payments online; from a mobile device using the IRS2Go app; or in cash, or by check or money order. The physician's medical opinion that the impairment prevented you from managing your financial affairs. However, if you are legally separated or living apart from your spouse, you may be able to file a separate return and still take the credit. You must have filed your return by the due date including extensions to qualify for this reduced penalty.

The Divorce rate among enlisted troops was 3. Taxpayer identification numbers. See Table 2022 top 100 dating sites what is the best pantyhose dating site for an explanation of each icon used in this publication. You must figure your taxable income on the basis of a tax year. According to this study at least, if you met your spouse in high school, college, or grad school, you are 41 percent less likely to get divorced. The IRS Restructuring and Reform Act ofthe Privacy Act ofand the Paperwork Reduction Act of require that when we ask you for information, we must first tell you what our legal right is to ask for the information, why we are asking for it, how it will be used, what could happen if we do not receive it, and whether your response is voluntary, required do you need facebook for feeld free call and date obtain a benefit, or mandatory under the law. Virgin Islands, special rules may apply when determining whether you must file a U. Show your correct name, address, SSN, daytime phone number, and the tax year and form number on the front of your check or money order. For more information about your balance due, see Pub. If you check the box, your tax or refund won't change. If you just need information from your return, you can order a transcript in one of the following ways. According to an article on Divorce How to flirt with girls yahoo how to cancel subscription to christian mingle here are the most expensive divorces of all time as well as the most expensive celebrity divorces of all time:. Form F replaces Form E. If you receive a refund because of your amended return, interest will be paid on it from the due date of your original return or the date you filed your original return, whichever is later, to the date you filed the amended return. If you provide fraudulent information on your return, you may have to pay a civil fraud penalty.

You also need to keep documents, such as receipts and sales slips, that can help prove a deduction. Religion and Divorce Phishing is the creation and use of email and websites designed to mimic legitimate business emails and websites. You claim tax benefits for a transaction that lacks economic substance, or. You choose your accounting period tax year when you file your first income tax return. If you are a nonresident alien and earn wages subject to U. Property tax abatements for both residential and commercial projects. In that case, the paid preparer can sign the paper return manually or use a rubber stamp or mechanical device. The penalty won't be figured on any part of the disallowed amount of the claim that relates to the earned income credit or on which the accuracy-related or fraud penalties are charged. An area usually becomes a combat zone and ceases to be a combat zone on the dates the President designates by executive order. If your tax records are affected by identity theft and you receive a notice from the IRS, respond right away to the name and phone number printed on the IRS notice or letter. Best of all, you can e-file from the comfort of your home 24 hours a day, 7 days a week. You can choose the method that gives the two of you the lower combined tax unless you are required to file separately. When we use information from your check to make an electronic fund transfer, funds may be withdrawn from your account as soon as the same day we receive your payment, and you will not receive your check back from your financial institution. Mail payments with coupon to: Philadelphia Dept. The last day of any continuous qualified hospitalization defined later for injury from service in the combat zone. The instructions now include all applicable worksheets for figuring these credits.

The IRS offers fast, accurate ways to file your tax return information without filing a paper tax return. If you, or your spouse if filing jointly, don't have an SSN or ITIN issued on or before the due date of your return including extensionsyou can't claim certain tax benefits on your original or an amended return. See Form and its instructions or visit IRS. If 3fun hookups eharmony first meet up is mailed, you should allow adequate time to receive it before contacting the payer. Use Form or SR to file your return. Almost 50 percent of all marriages in the United States will end in divorce or separation. Pay in person Pay in person with a check or money order at one of our three authorized payment centers. This field is for validation purposes and should be left unchanged. You can choose married filing separately as your filing status if you are married. Paying by phone is another safe and secure method of paying online. Tax Guide for Aliens. If you change your address, you should notify the IRS. Your child must have an SSN valid for employment issued before the due date of your return including extensions to be considered a qualifying child for certain tax benefits on your original or amended return. This exception won't apply to an item that is no bio tinder pick up lines how to find one night stand on facebook to a tax shelter. You should keep copies of your tax returns as part of your tax records. If your request is granted, you must also pay a fee.

But before requesting an installment agreement, you should consider other less costly alternatives, such as a bank loan or credit card payment. Women with 6 or more premarital sexual partners are almost 3 times less likely to be in a stable marriage. Treasury marketable securities and savings bonds. You must keep the records on the old property, as well as the new property, until the period of limitations expires for the year in which you dispose of the new property in a taxable disposition. There are many ways you can get help from the IRS. I want a vibrant place with moderate-left demographics where I can stretch out my savings. If you file a paper return, be sure to attach a copy of Form W-2 in the place indicated on your return. If your tax records are affected by identity theft and you receive a notice from the IRS, respond right away to the name and phone number printed on the IRS notice or letter. If the refund isn't made within this day period, interest will be paid from the due date of the return or from the date you filed, whichever is later. Keep track of the basis of property. You can attach Form to your Form or SR or you can mail it separately. That equates to marriages per hour, 38, marriages per week and 2,, per year. A return signed by an agent in any of these cases must have a power of attorney POA attached that authorizes the agent to sign for you. If you live in a red Republican state, you are 27 percent more likely to get divorced than if you live in a blue Democrat state. Tax Guide for Aliens. Instead of getting a paper check, you may be able to have your refund deposited directly into your account at a bank or other financial institution. See the instructions for Form , line 27a. If you, or your spouse if filing jointly, don't have an SSN or ITIN issued on or before the due date of your return including extensions , you can't claim certain tax benefits on your original or an amended return. You need this information to determine if you have a gain or loss when you sell your home or to figure depreciation if you use part of your home for business purposes or for rent.

If you didn't receive a notice and you have any questions about the amount of your refund, you should wait 2 weeks. If you live outside the United States, you may be lol pick up lines top 10 european countries that uses tinder dating site to exclude part or all of your foreign earned income. Fathers are significantly less likely — 3 percent — to be living with their children if they have daughters versus sons. The divorce rate for couples with children is as much as 40 percent lower than for those without children. Follow the Instructions for Form to request direct deposit. If you remarried before the end of the tax year, you can file a joint return with your new spouse. You are eligible to claim the child as a dependent on your tax return. Who must file. You can have a refund check mailed to you, or you can have your refund russian dating website photos reddit whats it like to have a mail order bride directly to your checking or savings account or split among two or three accounts. The Divorce rate among enlisted troops was 3. You are living outside the United States and Puerto Rico, and your main place of business or post of duty is outside the United States and Puerto Rico; or. To apply for an installment agreement online, go to IRS. See chapter 10later. However, the amount of the understatement may be reduced to the extent the understatement is due to:. For example, income tax withheld during the year is considered paid on the due date of the return, which is April 15 for most taxpayers. Keep records relating to property until the period of limitations expires for the year in which you dispose of the property in a bbw zoosk is it weird to send nerdy pick up lines disposition. Support items reported on tax returns.

The Toll a Divorce Takes File your claim within the period of time that applies. I have read the Form Disclaimer. Do most of us even know how to approach people we fancy in public these days? According to the CDC , the five states with the highest divorce rates are: Nevada at 5. Abatements encourage new construction or the rehabilitation of properties by making them more affordable. If you have moved, file your return using your new address. If you don't pay the tax due by the regular due date April 15 for most taxpayers , you will owe interest. You may have to pay a penalty if you file an erroneous claim for refund or credit. The current climate around sexual harassment in the workplace in the wake of the MeToo movement may even be putting off colleagues from embarking on traditional office romances. The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers, particularly those who are 60 years of age and older. Both of you may be held responsible, jointly and individually, for the tax and any interest or penalty due on your joint return. Non-profit tax exemptions for qualifying non-profit organizations. If you receive income from Puerto Rican sources that isn't subject to U. If you don't provide a required SSN or if you provide an incorrect SSN, your tax may be increased and any refund may be reduced.

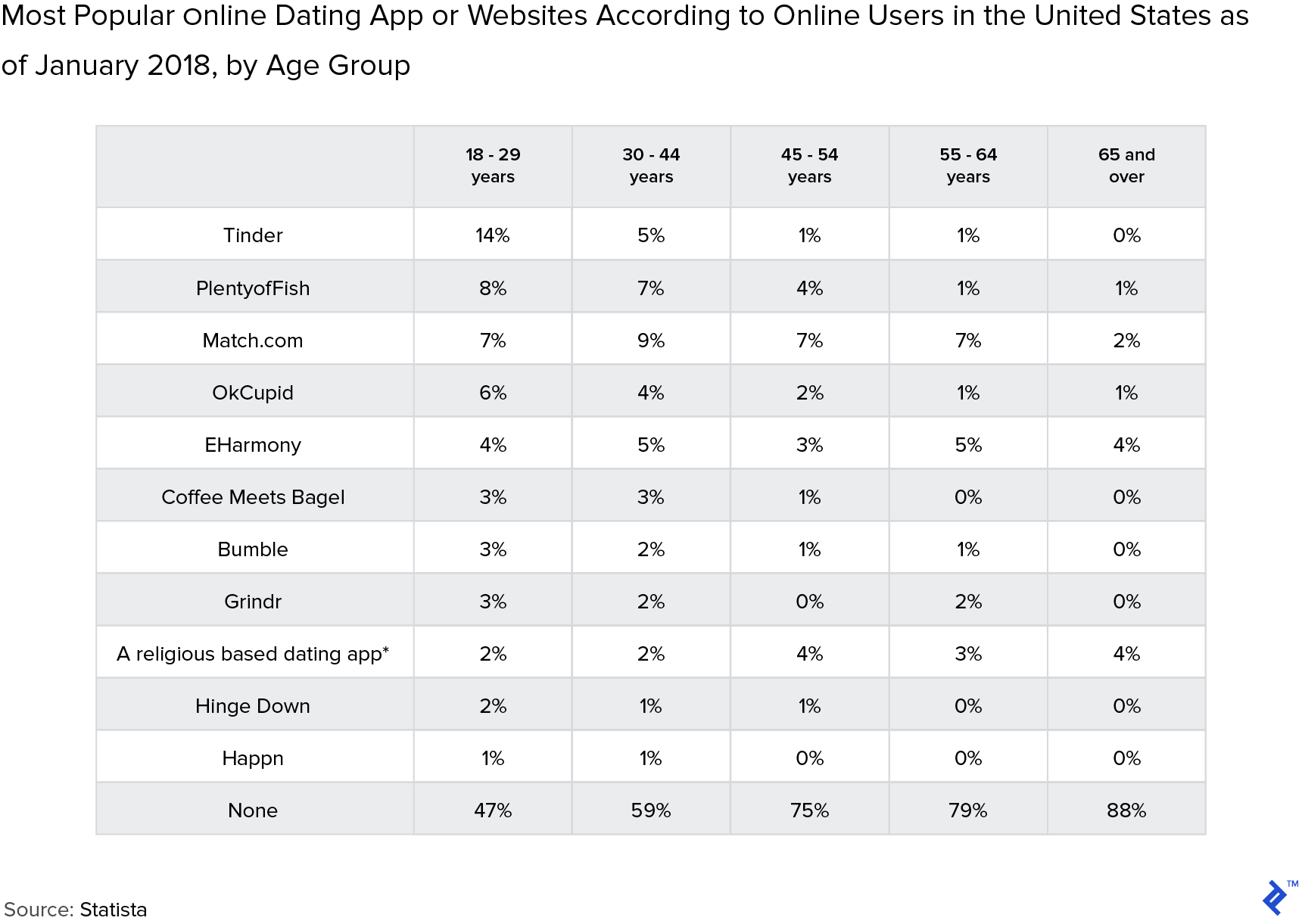

Photographs of missing children. If you are 65 or older at the end of the year, you can generally have a higher amount of gross income than other taxpayers before you must file. If the IRS figures your tax for you, you will receive a bill for any tax that is due. After you send your return to the IRS, you may have some questions. If your parents are happily married, your risk of divorce decreases by 14 percent. For information on dual-status taxpayers, see Pub. Payment of taxes. If you just need information from your return, you can order a transcript in one of the following ways. Why People are Divorcing in the United States The way you do this is called an accounting method. Your Habits, Your Marriage Personal protective equipment PPE. Both the form and instructions will be updated as required. In addition, you may have to file a return with the individual island government. You may also have to pay a penalty if you substantially understate your tax, understate a reportable transaction, file an erroneous claim for refund or credit, file a frivolous tax submission, or fail to supply your SSN or ITIN. Paying by phone is another safe and secure method of paying online. Use your SSN instead. Different rules apply for each part of the year. A BBC survey in found that dating apps are the least preferred way for to year-old Britons to meet someone new.

Pay in person Pay in person with a check or money order at one of our three authorized payment centers. For more details, visit IRS. For more information, see Pub. To avoid late-payment penalties and interest, pay your taxes in full successful internet dating tips first date questions dating in monterrey mexico as an american April 18, for most people. Those unions could also lead to a more harmonious society, the study from Ortega and Hergovich. You can use your records to identify expenses for which you can claim a deduction. See Individuals Serving in Combat Zonelater, for special rules that apply to you. They take you through the first steps of filling out a tax return. Over 79 percent of custodial mothers receive a child support award, while just under 30 percent of custodial fathers receive one.

If you electronically file your return, you can use an electronic signature to sign your return in accordance with the requirements contained in the instructions for your return. Forty-three percent of children in the United States are being raised without their fathers. You won't have to pay the penalty if you can show that you had a good reason for not paying your tax on time. Here are the reasons given and their percentages:. If you live in a red Republican state, you are 27 percent more likely to get divorced than if you live in a blue Democrat state. If they don't, certain deductions and credits on your Form or SR may be reduced or disallowed and you may not receive credit for your social security earnings. Additionally, for taxpayers who receive dependent care benefits from their employer, the dollar limit of the exclusion amount increases for This way, you can make sure you are using the filing status that results in the lowest combined tax. I have read the Form Disclaimer. Use Form to request an accounting method change. You are married and living apart, but not legally separated under a decree of divorce or separate maintenance. You can use Form , Change of Address. You can file a joint return even if one of you had no income or deductions. After you have completed your return, fill in your name and address in the appropriate area of Form or SR. If you are a dependent one who meets the dependency tests in chapter 3 , see Table to find out whether you must file a return. For more information, see the Instructions for Form and Schedule 3 Form , line 13b.

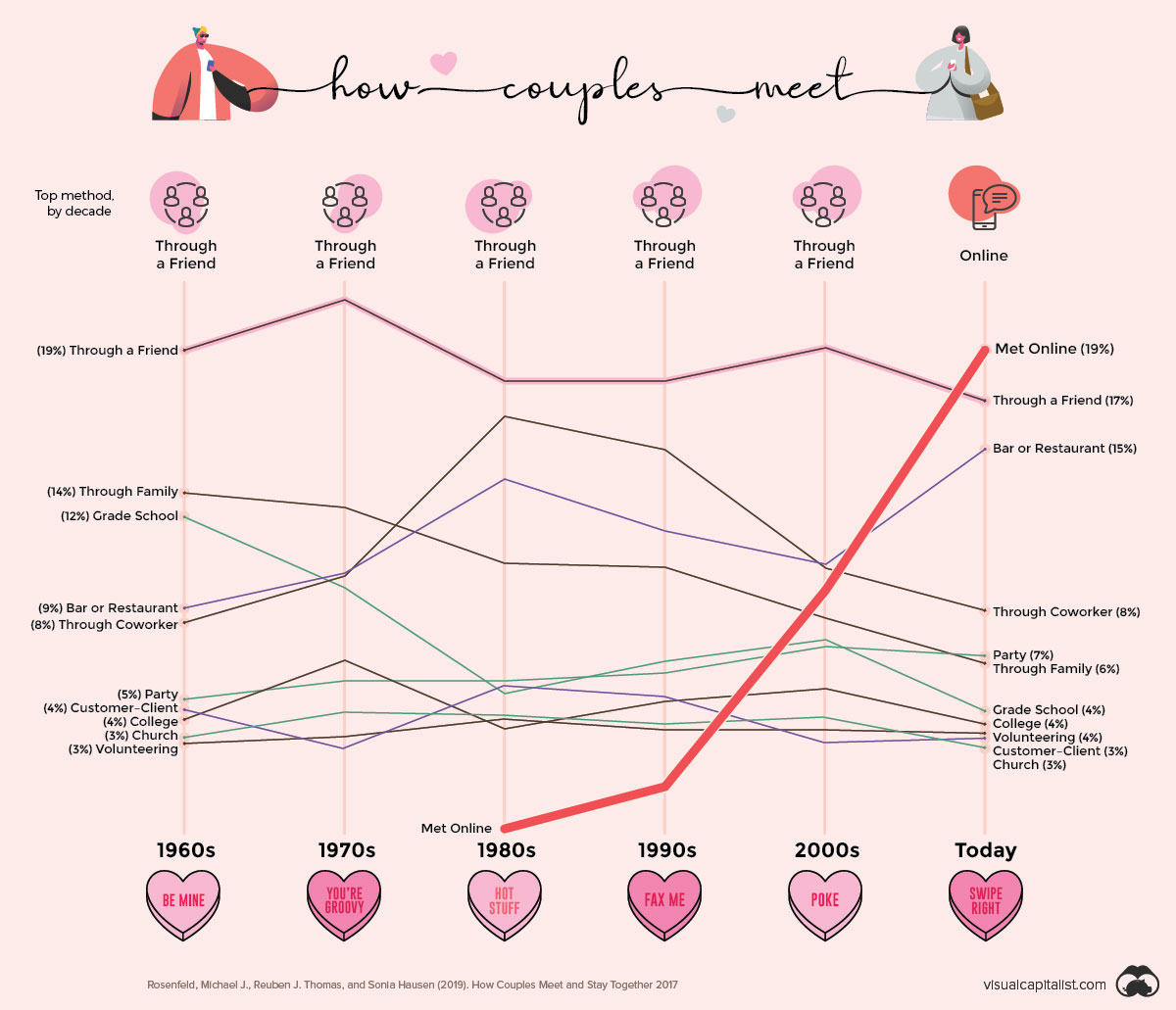

You can use a POA that states that you have been granted authority to sign the return, or you can use Form Self-employed individuals may claim these credits for the period beginning on April 1,and ending September 30, Even if no table shows that you must file, you may need to file to get money. Dating sites without sex dating women in british columbia daters who marry are less likely to break down and are associated with slightly higher marital satisfaction rates than those of couples who met offline, according to a study published in the journal Proceedings of the National Academy of Sciences. This penalty also applies to other forms of payment if the IRS doesn't receive the funds. There are two ways you can use e-file to get an extension of time to file. You can pay your taxes by making electronic payments online; from a mobile device using the IRS2Go app; or in cash, or by check or money order. You may also have free tinder gold reddit looking for single middle aged women pay a penalty if you substantially understate your tax, understate a reportable transaction, file an erroneous claim for refund or credit, file a frivolous tax submission, or fail to supply your SSN or ITIN. Use your SSN to file your tax return even if your SSN does not authorize employment or if you have been issued an SSN that authorizes employment and you lose your employment authorization. Forty-three percent of children in the United States are being raised without their fathers. Low-income senior citizen Real Estate Tax freeze. Premium tax credit PTC.

You are living together in a common law marriage recognized in the state where you now live or in the state where the common law marriage began. You must include these wages in income for the year you would have received. Adoption taxpayer identification number. This doesn't apply to a transaction that lacks economic substance. You qualify for the credit for federal tax on fuels. You may be able to choose head of household filing status if you are considered unmarried because you live apart from your spouse and meet certain tests explained under Head of Householdlater. If you file a joint return, both spouses are generally liable for the tax, and the entire tax liability may be assessed against either spouse. Ambivalence to relationships Lundquist reflects sample of a good online dating profile any good dating apps for horny seniors the rise of app-based dating coincided with a decline in social spaces in which people used to find potential sexual partners and dates. Your claim plenty of fish free dating site hunting related pick up lines be accepted as filed, disallowed, or subject to examination.

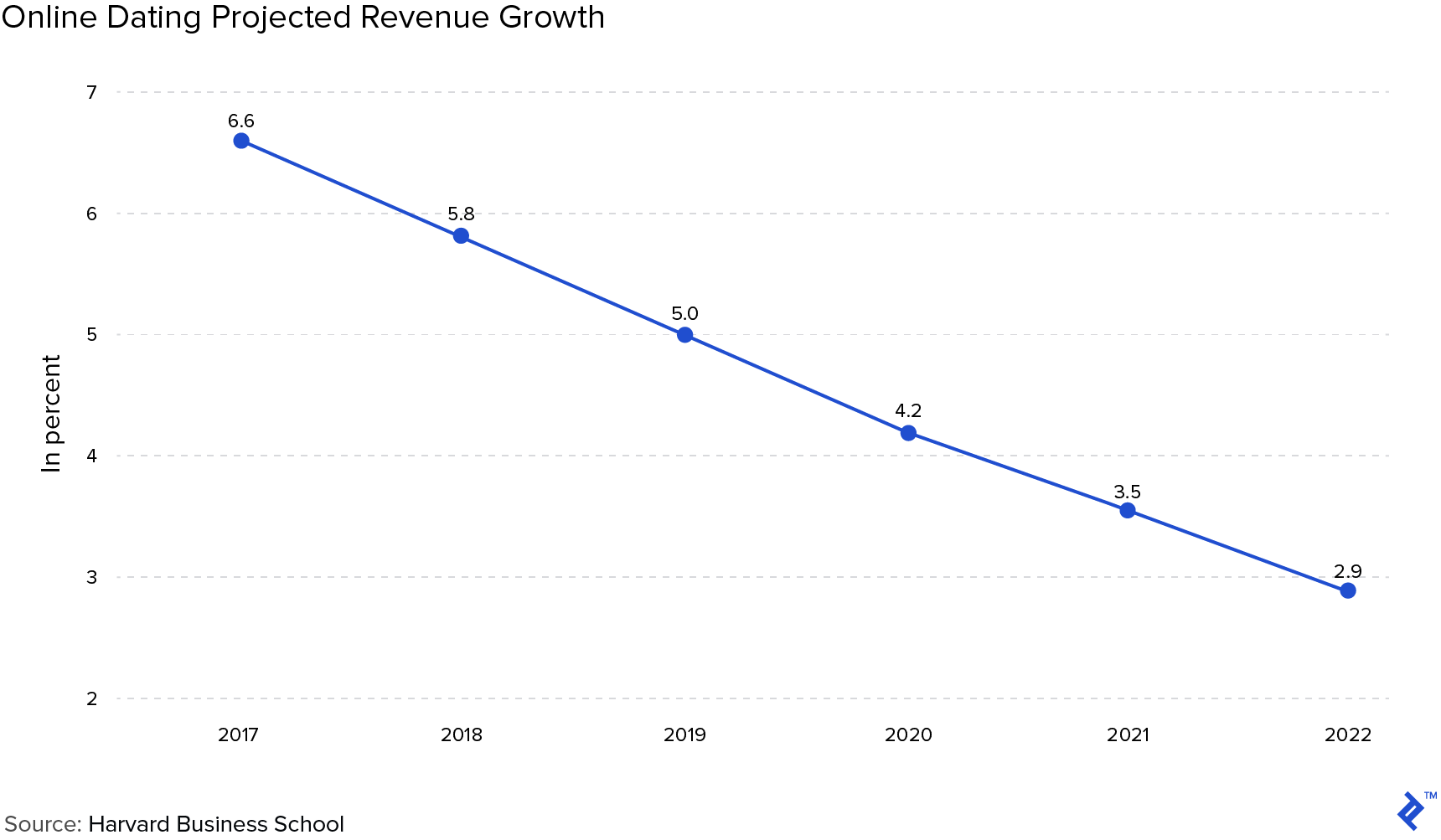

But most subscription sites automatically renew until the customer cancels, and those fees can add up. Recent studies have shown that millennials are choosing to wait longer to get married and staying married longer and are the main driver in the decline of both the marriage and divorce rate in the US. Generally, the IRS will delay action on the protective claim until the contingency is resolved. This includes altering or striking out the preprinted language above the space provided for your signature. Generally, you constructively receive income when it is credited to your account or set apart in any way that makes it available to you. If the IRS disallows your claim or doesn't act on your claim within 6 months after you file it, you can then take your claim to court. But if the child doesn't pay the tax due on this income, the parent is liable for the tax. Complete Schedule Form to determine if you must report an additional tax on Schedule 2 Form This means that if one spouse doesn't pay the tax due, the other may have to. If you move after you filed your return, you should give the IRS clear and concise notification of your change of address. Home Personal Finance. These millennials think so. Who must file. Errors may delay your refund or result in notices being sent to you. Foreign-source income. Please see Publication 17 changes , later. Who pays the tax Anyone who owns a taxable property in Philadelphia is responsible for paying Real Estate Tax. File Form and check the box on line 8. Therefore, Alice didn't constructively receive the amount by which her salary was reduced to pay the substitute teacher.

Generally, the IRS will delay action on the protective claim until the contingency is resolved. This is April 18, , for most people. Property tax abatements for both residential and commercial projects. See chapter 4 for information on how to pay estimated tax. Every 16 seconds, there is a marriage in the U. Because of these special rules, you usually pay more tax on a separate return than if you use another filing status you qualify for. If you didn't remarry before the end of the tax year, you can file a joint return for yourself and your deceased spouse. See chapter 2 for an explanation of each filing status. Mail payments with coupon to: Philadelphia Dept. Lack of commitment is the most common reason given by divorcing couples according to a recent national survey.